Two weeks before a best‑and‑final on a 200‑unit deal, an acquisitions lead told me, “If AI can get us to a first pass in half the time, that is all I care about.”

They were getting crushed on bandwidth. Two analysts, three live deals, inbox on fire. Faster sounded like salvation.

They got their speed. A generic AI tool cranked out quick deal summaries and “IC‑ready” talking points. The team moved faster.

They also missed a tax reset buried in a county document and a lender covenant that behaved differently than they assumed. When IC pressed on the details, the story did not quite hold. They pulled their bid, not because the math killed it, but because confidence did.

That is the part most people miss.

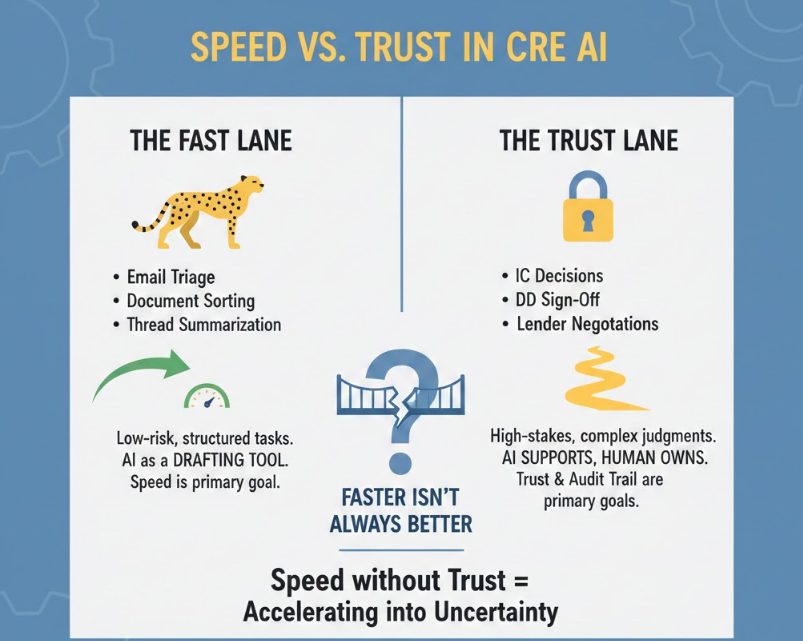

In CRE, speed helps only when it rides on top of trustworthy, auditable work. If AI gives you fast answers that you cannot stand behind in front of a lender, an IC, or a capital partner, you are not ahead. You are just accelerating into uncertainty.

Here is why faster is not always better in CRE AI, and where you actually want to slow down.

The Wrong Question: “How Do We Make This 10x Faster?”

When partners talk about AI, the first instinct is usually:

- “Can we cut underwriting time in half?”

- “Can we generate IC decks in minutes?”

- “Can we answer brokers immediately?”

Those are understandable questions. They are also incomplete.

For most core workflows, you do not get paid for speed in isolation. You get paid for:

- Bidding the right deals at the right price

- Catching real risk before you sign a PSA or close

- Showing up to IC with a story, a model, and a risk view that line up

If AI helps you move faster in places where you already have tight controls and a shared mental model, it is a win.

If AI helps you move faster in places where you are still improvising, you quietly push error into the system.

The real question is closer to:

“Where can we let AI go fast because we have the right guardrails, and where should we force it to slow down to protect judgment and trust?”

Three Ways “Faster” Backfires In CRE AI

1. Fast Drafts That Outrun Your Ability To Check Them

The classic trap: use AI to write IC memos, lender narratives, and DD reports “in seconds.”

You feed in:

- The model

- A few notes from email threads

- Maybe an OM

You get back something that looks polished. Bullet points, sections, even “risks and mitigants.”

The problem is not that the draft is bad. The problem is review debt.

To trust that document, someone senior now has to:

- Cross‑check numbers against the model and source docs

- Make sure the story matches what was actually negotiated

- Confirm that nothing material got invented to fill a gap

If that review step is not explicit and scoped, the team does one of two things:

- Skims and hopes nothing serious is off, because time is short

- Rewrites large parts of the draft, which kills the time savings

Either way, the “speed” you gained on drafting reappears on the review side. Worse, the firm has now blurred the line on what is human‑vetted and what is AI‑generated.

Where to go fast:

Use AI for structured, low‑risk drafting where the inputs are already locked:

- Formatting a standardized IC template from a clean data pack

- Turning a lease abstract table into a short tenant summary you will edit

- Generating alternative versions of a paragraph to tighten language

Where to slow down

Anything that combines numbers, narrative, and risk for external consumption should have:

- A clear owner

- A short list of fields that must be checked back to source

- A checkpoint where someone with signing authority approves it

AI can help draft. Human review controls the speed.

2. “Instant” Analysis That Bypasses Source Documents

The second failure mode is asking AI for direct answers instead of structured extraction.

Examples:

- “What is the NOI and cap rate on this deal?”

- “What covenants does the lender require?”

- “What are the key risks in this environmental report?”

If you pass in the actual OM, term sheet, or report and ask the model to lift specific fields and quotes, you have a path back to ground truth.

If you paste random snippets or describe the deal in natural language and ask for conclusions, you are effectively saying:

“Please interpolate and guess.”

AI is good at sounding confident. In CRE that is dangerous.

On a live deal, “instant” answers that are one step removed from the PDF or email turn into:

- Mismatched numbers between the model and the memo

- Misquoted covenants in internal discussion

- Vague risk language that does not match the report when someone reads it carefully

At that point, speed has just pulled distrust forward.

Where to go fast

Use AI to:

- Parse OMs, T‑12s, rent rolls, and term sheets into structured tables

- Tag and quote specific clauses in leases, PSAs, and loan docs

- Build quick comparison tables across multiple quotes or deals

You still decide what the inputs mean. AI’s job is to get you clean data fast.

Where to slow down

Anything that smells like:

- “What should we bid?”

- “Is this loan structure acceptable?”

- “Is this risk acceptable for our fund?”

Those are not AI questions. They are investment committee questions. AI can support them with data and summaries, but you do not want a “fast” answer there. You want a correct, owned answer.

3. Scaling Bad Processes Faster

The third problem is less obvious.

If your current process already has weak spots, AI will happily scale them.

Examples:

- Pipeline sheets that are inconsistent across markets and teams

- DD checklists that are generic and often half‑filled

- Informal ways of capturing lender conditions or seller concessions

If you drop AI in and say, “Make this faster,” you often get:

- Faster ingestion of emails and documents into inconsistent templates

- Faster creation of DD notes that still do not flow into memos or models

- Faster spread of assumptions that were never blessed in the first place

Speed multiplied by noise does not give you signal. It just fills your systems faster with things you cannot compare or trust.

Where to go fast

Once you have agreed on:

- A standard deal intake schema

- A DD checklist that actually matches how you think about risk

- A lender comparison format your team believes in

then AI can:

- Auto‑populate those structures from email and documents

- Keep them updated as new information comes in

- Alert you when a new document contradicts an earlier assumption

Where to slow down

Before you let AI loose on a workflow, spend real time on:

- Naming the fields that matter

- Deciding who owns them

- Defining how they flow into your model and IC process

Partners tend to rush through that part because it feels “manual.” In reality, that is the design work that makes AI worth having.

Where Speed Actually Wins In CRE AI

This piece has pushed hard on the downside of “faster,” so it is worth being explicit about where speed really is an advantage.

Good candidates:

- Email triage

Turning broker and lender inbox clutter into a structured intake sheet within hours, so the team can quickly decide what deserves a model. - Document sorting and extraction

Identifying which leases, contracts, and reports have meaningful differences from your standard expectations, so legal and asset management can focus on the few that matter. - Thread summarization

Summarizing long email chains into clean lists of “Key terms / Changes / Open issues” so partners walk into IC or lender calls with a clear picture.

In all three, the cost of an AI miss is low as long as:

- You treat the output as a draft view, not a final decision

- You know how to get back to the underlying source quickly

In those areas, faster really does feel better. Analysts get their time back. Partners get a clearer picture sooner. Everyone is working off the same spine of information.

How To Talk About Speed With Your Team And Still Sleep At Night

If you are setting direction on AI for a CRE firm, you can keep this simple.

- Name the places where speed is the primary goal.

Email triage, document sorting, pipeline hygiene. Give AI permission to go fast there. - Name the places where trust and audit trail are the goal.

IC decisions, DD sign‑off, lender negotiations. Force AI to slow down there, even if that means fewer use cases at the start. - Write down one rule about numbers.

For example: “Any value that goes into a model or memo must be traceable to a specific page or paragraph in a source document, regardless of whether AI touched it.” - Measure speed gains only where quality is already controlled.

Hours saved on email and document wrangling, not “time to decision” on nine‑figure commitments.

If you get this right, AI will absolutely make you faster.

You will just be faster at the parts that free your team to think, instead of faster at pushing shaky assumptions into big decisions.

That is the version of “faster” that actually wins you better deals, not just more motion.