If you’ve underwritten even a handful of deals, you know the pain: you get an income and expense statement from a property owner, and it’s a mess. Vague line items like “Repairs & Misc.” or “Admin/Other” don’t tell you much. So, you end up spending precious time remapping every line into your own chart of accounts.

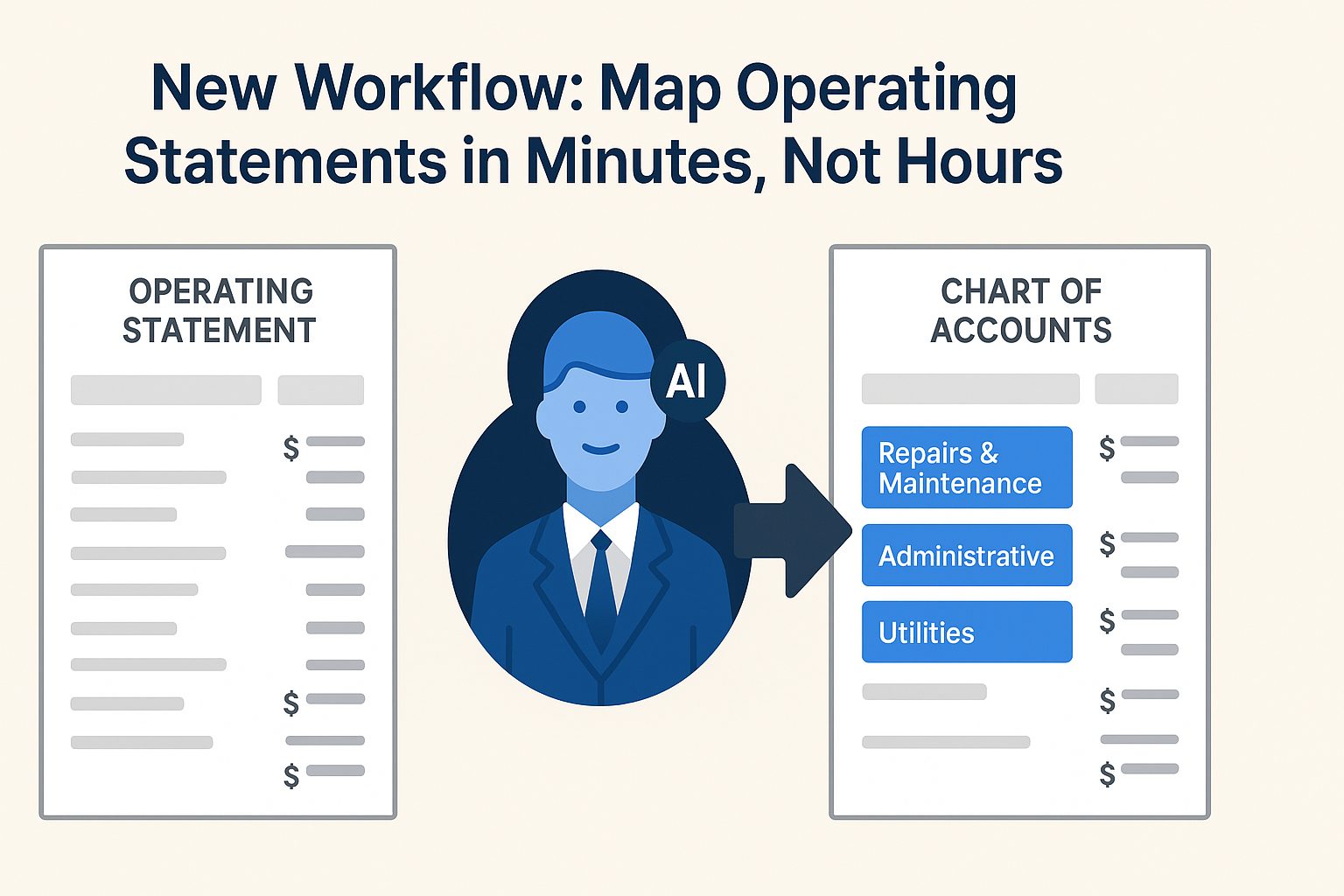

Now, that process—mapping operating statements—just got a major upgrade. Your CRE Agents digital coworker – the smartest AI Agent in Commercial Real Estate – is ready to help.

What Is Mapping and Why It Matters

Mapping is the step where you take raw, owner-specific accounting and convert it into something standardized, consistent, and useful for your models and tools. It’s not glamorous, but it’s essential. Here’s why:

- Apples-to-apples underwriting: Every owner or manager uses different terminology. Mapping brings clarity. For instance, remapping “Snow Removal” to “Repairs and Maintenance” or “Admin/Other” to “Administrative” so you can consistently compare line items and metrics across deals.

- Automation-ready data: Clean inputs prevent formulas from breaking in Excel, ARGUS, or your internal platform.

- Audit-friendly transparency: When your mapped version clearly ties back to the original, it’s much easier to defend your work to investors and lenders.

The Prep: Getting to a Mappable Format

Before you can even begin mapping, there’s the setup. Property income statements arrive in a wide variety of formats, everything from messy scanned PDFs to direct exports from Yardi or RealPage. They’re rarely plug-and-play.

Traditionally, the analyst has to prep the data first: pull it into Excel, clean it up, maybe even transcribe it by hand. That pre-mapping work can take anywhere from a few minutes to over an hour, depending on the original format and quality.

Now, with a CRE Agents digital coworker trained to handle that tedious prep, you get that time back to focus on what actually moves the needle in your underwriting.

The Old Way: Manual and Error-Prone

Historically, mapping meant grunt work. Analysts manually retyped or re-sorted each line item, leading to common errors like:

- Misclassifying CapEx as OpEx (phantom NOI, anyone?)

- Overlooking key details in “Other Income” (think parking, RUBS, laundry)

Each deal could eat up 30 to 60+ minutes, and one mapping mistake could throw off your entire analysis.

The New Workflow: Extract, Organize, Map

We built a better way. Our new mapping workflow allows your digital coworker to automate the hard stuff. Here’s what it does:

- Extracts line items from the operating statement into a CSV

- Groups them into your standard chart of accounts

- Sums each group to produce clean, import-ready totals

No guesswork. No drudgery. Just results in minutes.

Meet Vic: Trained to Perform Workflows like this 24/7

The magic behind the scenes? Vic, our digital coworker.

Vic is trained to perform workflows just like this one: to map operating statements with high accuracy. He’s available 24/7 and doesn’t take coffee breaks. We even trained Vic to double-check his work: after mapping, he compares the mapped NOI to the original to confirm alignment. And even if they don’t match, Vic’s analyst partner has all the details at their fingertips to quickly clean up and finalize the mapping, turning a task that used to take hours into minutes.

Why This Matters

Because mapping is where underwriting is won or lost. Nail it once, accurately, and everything downstream works as it should.

So, the next time someone shrugs and says, “It’s just bookkeeping,” smile and nod. Because you know better. And now, so does Vic!