Every few months (or weeks!0, a new frontier model drops with better reasoning, longer context, sharper tools. The tech press focuses on benchmarks and demos. If you are running a commercial real estate firm, you care about something else:

Does any of this actually move the needle for us?

From where I sit, working on AI built for commercial real estate every day, the answer is yes. But not in the way most vendors pitch it.

The ongoing releases of better frontier models matter a lot, if you have the right CRE layer on top of them. Without that layer, you are just getting slightly nicer chat experiences. With it, each new model release quietly upgrades the AI coworker that supports your team on real work: underwriting, leasing, investor reporting, asset management, capital markets.

This post is about what that really looks like for CRE Agents clients and for decision-makers who are trying to choose an AI strategy that will still make sense 3 years from now.

The simple version: the engine keeps getting better, your CRE stack stays the same

Think about the models (Google’s Gemini, OpenAI’s GPT-x, Claude’s Sonnet/Opus, etc.) as the engine, and your CRE-specific layer as the vehicle built around it.

The engine keeps improving:

- Better long-form reasoning

- Fewer hallucinations

- Larger context windows

- Better tool use and code-writing

But your team does not want to compare engines every quarter. You want a stable operating layer that:

- Understands your workflows

- Knows your templates

- Integrates with your systems

- Produces outputs your team actually trusts

The promise of AI built for commercial real estate is that you do not have to keep rebuilding the vehicle every time a better engine shows up. When we upgrade the engine on the CRE Agents side, the CRE-specific layer (Personas, Workflows, guardrails, templates, integrations) all stay intact.

So, if you are a CRE Agents client, here is what model improvements actually translate into in your day-to-day.

What gets better every time models improve

1. Deeper, cleaner reasoning inside CRE workflows

Frontier models are getting much better at:

- Multi-step reasoning

- Keeping a long chain of logic consistent

- Explaining “why,” not just “what”

In CRE workflows, that shows up in places like:

- Underwriting support

- Clearer explanations of where assumptions conflict

- Better sensitivity narratives (“if you push rents here, this is what breaks”)

- Fewer logical slips in long cash-flow commentary

- IC memos and investment briefs

- More consistent story from market section to business plan to risk factors

- Stronger “investment thesis vs. what can go wrong” framing

- Less clean-up time for associates and VPs

You are not buying a model. You are buying fewer redlines, faster drafts, and more time for your highest-value people to think.

2. More reliable execution on messy, real-world tasks

The big jump with each generation is not “can it write a paragraph,” it is “can it survive real-world mess.”

CRE work is full of that:

- PDFs with broken formatting

- Offering memos where the key number is buried in a footnote

- Rent rolls with edge cases everywhere

- Calendars, emails, and call notes that all tell part of the story

As models improve at tool use, parsing, and error recovery, your AI coworkers get better at:

- Pulling the right data out of ugly PDFs and rent rolls

- Flagging “this field looks wrong” instead of silently accepting it

- Following complex, multi-step instructions inside Workflows without wandering off

For you, that means:

- Fewer manual checks on routine tasks

- Higher hit rate on “first draft is actually usable”

- More work you can safely hand off to the digital coworker

3. Stronger multi-document and multi-system context

Every CRE firm has a simple version of the same problem: the information needed for a single decision is split across systems. Email, Excel, CRM, shared drives, OM PDFs, lender quotes.

Bigger, better models with long context are good at two things here:

- Keeping more of that context “in mind” at once

- Not losing the thread across a 20- or 30-step workflow

In practice, that unlocks:

- Pre-meeting briefs that stitch together calendar, email history, and your pipeline

- Deal summaries that reference past versions of the model and prior IC notes

- Portfolio views that remember how one asset’s story relates to another

The CRE Agents layer wires those sources together. Frontier models give that wiring more “bandwidth” and better reasoning.

What does not change, even as models keep improving

This is the part that is easy to miss in the hype. As models get better, some things do not change:

1. You still need CRE-specific structure

A frontier model, on its own, does not know:

- How your team defines “go / no-go” on a deal

- What your IC memo sections are called

- How you like risk framed for different capital partners

- How your internal rent roll template is laid out

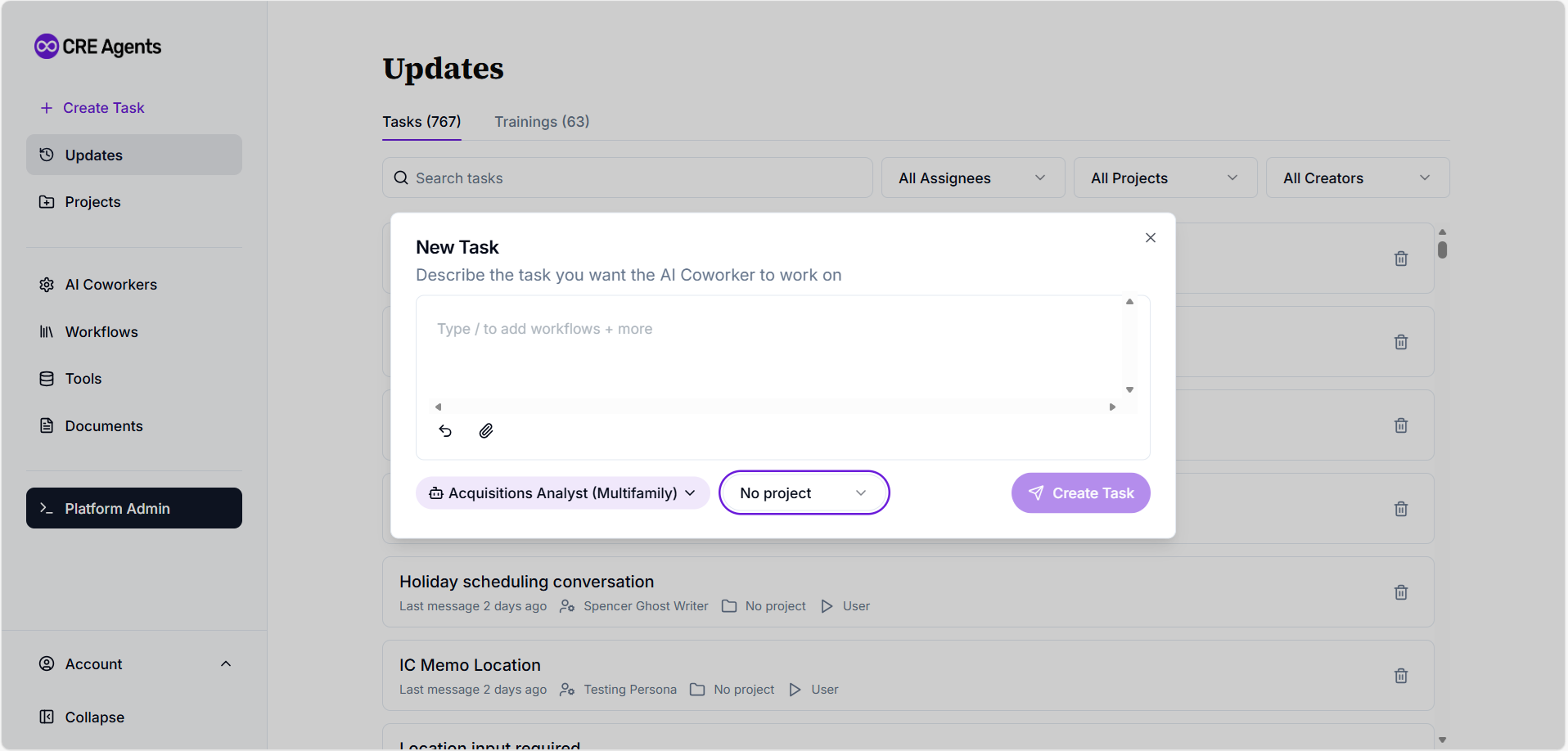

That is the work we do with Personas and Workflows:

- Codifying your underwriting memos, lender packages, broker follow-ups

- Capturing your firm’s language, thresholds, and formatting

- Turning “how we do this here” into a reusable, automated playbook

Every new model makes those playbooks more capable, but it does not write them for you.

2. Data quality and access still matter more than model choice

The best model in the world will still produce weak results if:

- It never sees your real rent rolls

- It is not integrated with real-world data

- It guesses at your risk appetite

- It works from OMs alone

The durable advantage is not “we use Model X.” It is:

- How tightly your AI layer is wired into the way you already run deals

- How well your processes are captured in natural language Personas

- How much of your institutional knowledge is actually available to your digital coworker

Frontier models amplify what is already there. If the inputs are thin, the amplification does not help much.

3. Governance and trust still need to be solved at the firm level

No model release will solve:

- Who is allowed to approve the AI coworker’s output for investors

- Which workflows are “assist-only” vs. “auto-draft and send”

- What gets logged, versioned, and auditable for compliance

- How errors are caught, learned from, and prevented next time

Those are operating model questions. The CRE Agents platform is built with that in mind, but each firm still sets:

- Guardrails around usage

- Approval paths

- What “good enough” looks like in each workflow

New models make your AI coworkers more capable. Your internal governance makes that capability safe and repeatable.

What “AI built for commercial real estate” means in practice

To make this concrete, picture a near-term state at your firm:

- Your acquisitions team uses its AI coworker to:

- Pull key assumptions from OMs and rent rolls

- Draft IC memos and lender packages that match your templates

- Keep a clean, searchable trail of questions, revisions, and final assumptions

- Your asset management team uses its AI coworker to:

- Turn property management reports into concise owner updates

- Flag assets that look off versus pro forma

- Prepare talking points before borrower and LP check-ins

- Your leadership team uses its AI coworker to:

- Get weekly portfolio summaries in plain language

- Prep for board or IC meetings with context-rich briefs

- Identify where processes are bogged down and could be automated next

Under the hood, frontier models keep getting better. On the surface, your team just experiences:

- Higher-quality drafts on the first pass

- Less time spent reformatting and restating the same content

- More confidence that someone (even if digital) is watching the details

That is what “benefiting from model progress” looks like when you have AI built for commercial real estate wired into how your firm actually works.

How to get started, without committing to a science project

If you are curious how this would look inside your firm, you do not need a 12-month transformation plan.

The practical starting point:

- Pick one high-friction workflow

- IC memos, lender packages, investor updates, or recurring asset reports are usually good first candidates.

- Codify “how we do this here” in plain language

- We work with you to capture your format, tone, and decision logic as a Persona and Workflow.

- Run it side by side with your current process for a few weeks

- Use Vic’s drafts as a starting point. Track time saved and changes required.

- Decide whether to expand or adjust

- If the value is clear, we move to the next workflow. If not, we refine or pick a different use case.

Each time the frontier models improve, that same workflow just gets sharper.

If you want to see what AI built for commercial real estate would look like inside your firm, you can learn more about CRE Agents.